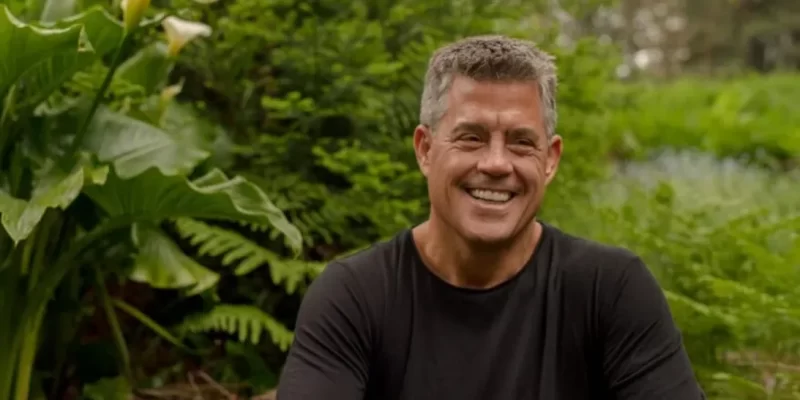

In the world of finance and investment, few names stand out as prominently as Brook B Taube. Known for his innovative approach and substantial achievements, Taube has become a respected figure in wealth management. His strategies and insights have not only helped shape the industry but also provided valuable lessons for those looking to grow and protect their wealth. In this article, we will explore 10 surprising insights on wealth management from Brook B Taube that can offer transformative benefits for your financial strategy. Whether you are an investor, entrepreneur, or simply interested in improving your financial knowledge, these insights will provide a deeper understanding of how to effectively manage and enhance your wealth.

Brook B Taube’s Approach to Risk Management

Brook B Taube emphasises the importance of a balanced approach to risk management. Unlike traditional strategies that might focus solely on minimising risk, Taube advocates for a nuanced understanding of risk that aligns with your overall financial goals. This approach involves assessing both the potential upsides and downsides of investment opportunities and making informed decisions that are in line with your risk tolerance. By adopting Taube’s approach, investors can achieve a more balanced and resilient portfolio.

Diversification Strategies from Brook B Taube

One of the key principles in Brook B Taube’s wealth management philosophy is diversification. Taube believes that spreading investments across various asset classes is crucial for mitigating risk and optimising returns. His diversification strategies go beyond traditional asset allocation and include geographic diversification, sector diversification, and even diversification across different investment vehicles. This multi-faceted approach helps in managing risk while tapping into various growth opportunities.

Brook B Taube on the Importance of Liquidity

Brook B Taube highlights the significance of maintaining liquidity in your investment portfolio. While it’s tempting to lock in funds for long-term investments with potentially high returns, Taube advises against neglecting liquidity. Having access to liquid assets ensures that you can seize new opportunities, respond to market changes, and cover unexpected expenses without needing to sell off investments at a loss. Taube’s focus on liquidity underscores the importance of balancing short-term accessibility with long-term growth.

Brook B Taube’s Views on Emerging Markets

According to Brook B Taube, emerging markets offer exciting growth potential but come with their own set of risks. Taube encourages investors to explore emerging markets as part of their diversification strategy, but he also stresses the importance of thorough research and understanding local market dynamics. By investing in emerging markets, you can tap into new opportunities for growth, but it’s essential to do so with a well-informed and cautious approach.

The Role of Technology in Modern Wealth Management

In the digital age, technology plays a pivotal role in wealth management. Leveraging advancements such as advanced analytics, artificial intelligence, and fintech innovations can enhance investment strategies and streamline financial planning. Embracing these technological tools provides valuable insights and efficiencies, keeping you competitive in a rapidly evolving financial landscape.

Sustainable Investing: Aligning Values with Financial Goals

Sustainable investing involves considering environmental, social, and governance (ESG) factors alongside traditional financial metrics. This approach not only aligns with ethical values but also offers long-term financial benefits. By integrating ESG criteria into your investment decisions, you can support companies with positive societal impacts while potentially achieving competitive returns.

Understanding Behavioral Finance and Its Impact

Behavioural finance explores how psychological factors influence financial decisions. Recognizing the impact of behavioural biases, such as overconfidence and herd behaviour, can help you make more rational and objective investment choices. Understanding these psychological traps is essential for improving investment outcomes and making informed decisions.

Strategies for Long-Term Wealth Preservation

Preserving wealth over the long term requires careful planning and strategic thinking. Key elements include estate planning, tax optimization, and risk management. By focusing on these areas, you can protect your wealth from unforeseen events, minimise tax liabilities, and ensure a smooth transfer of assets to future generations.

The Importance of Continuous Financial Education

Continuous financial education is a cornerstone of effective wealth management. Staying informed about market trends, investment strategies, and financial regulations is crucial for making sound decisions. Engaging with resources, attending seminars, and consulting financial professionals can enhance your knowledge and skills.

Personalization in Wealth Management Strategies

Tailoring financial strategies to individual needs and goals is a crucial aspect of effective wealth management. Personalising investment plans and strategies ensures better alignment with personal objectives and enhances the likelihood of financial success. Customising your approach can lead to more effective and satisfying financial outcomes.

Conclusion

Brook B Taube’s insights into wealth management offer a comprehensive and innovative approach to handling finances. His emphasis on balanced risk management, diversification, liquidity, and sustainable investing provides valuable guidance for both seasoned investors and those new to the world of finance. By integrating Taube’s principles into your financial strategy, you can better navigate the complexities of wealth management and position yourself for long-term success. Whether you’re interested in leveraging technology, exploring emerging markets, or focusing on personalised strategies, the lessons from Brook B Taube can help you build and preserve wealth effectively.

FAQs

1. What is Brook B Taube’s approach to risk management?

Brook B Taube advocates for a balanced approach to risk management, focusing on both potential upsides and downsides to align with overall financial goals.

2. How does Brook B Taube suggest diversifying investments?

Brook B Taube recommends diversification across various asset classes, geographic regions, and sectors to mitigate risk and optimise returns.

3. Why is maintaining liquidity important in a financial portfolio?

Maintaining liquidity ensures that you have access to cash for new opportunities, market changes, and unexpected expenses, allowing you to avoid selling investments at a loss.

4. What role does technology play in modern wealth management?

Technology, including advanced analytics, artificial intelligence, and fintech innovations, enhances investment strategies, streamlines financial planning, and provides valuable insights and efficiencies.

5. What are the benefits of sustainable investing?

Sustainable investing considers environmental, social, and governance (ESG) factors along with financial metrics, aligning with ethical values and offering potential long-term financial benefits by supporting companies with positive societal impacts.

Also read: Prince Narula Digital PayPal: 10 Ways to Leverage It for Competitive Advantage